Navigating the Charts: 7dig Share Price Uncovered

Investors are always on the lookout for the next undervalued gem that could provide significant returns. In the sprawling jungle of the stock market, one such contender that’s piqued the interest of many is 7dig, a company that’s creating ripples in the digital entertainment and streaming industry. This article aims to unravel the dynamics of 7dig’s share price and identify potential areas for coveted gains.

The 7dig Saga

Establishing a solid grounding is pivotal for any stock analysis. 7digital Group plc, often just referred to as 7dig, isn’t a new player in the market. The company has solid foundations, having been founded in 2004 in London. It has since navigated the complex seas of the digital music arena, offering a range of business-to-business digital music platform and service solutions. 7dig provides technical and commercial infrastructure to help music services operate and monetize, and this insight can be key to understanding its market resilience and potential for growth.

Enter the Financial Fray

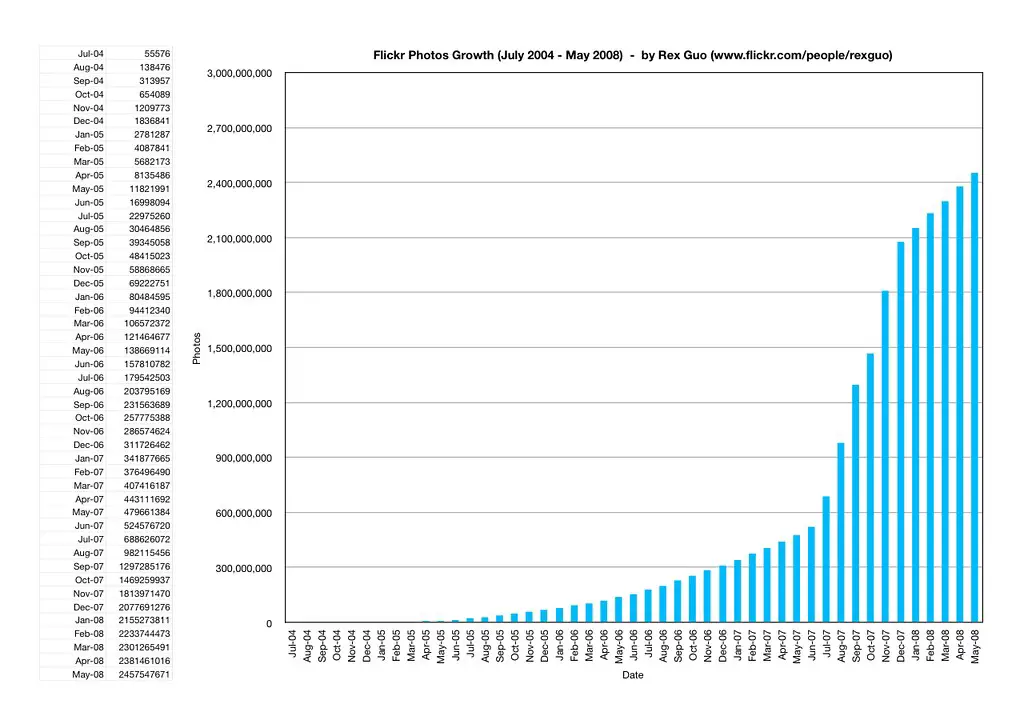

Stock price is often seen as the pulse of a company’s financial health. Examining 7dig’s share price dynamics over time can yield valuable insights into its current position and trajectory. Scrutinizing factors like historical trends, volume, and volatility can give investors a window into sentiment and activity around this stock.

Recent Trends and Market Performance

The digital entertainment industry is rife with dynamism, and this can be witnessed in 7dig’s recent performance. An exploration of its share price data over the past year would reveal if it has been a smooth sailing or a tumultuous voyage for investors. Share prices can often be subject to rapid changes influenced by business decisions, market trends, and macroeconomic shifts.

Influencing Factors

No stock price moves in a vacuum. In the case of 7dig, factors such as partnership announcements with streaming giants or shifts in consumer spending habits towards digital content could be guiding the ebb and flow of its share price. Understanding the unique context of this industry is key to predicting how outside influencers like new technologies and legislation may play out in the stock market.

The Alchemist’s Stone: Potential Gains in 7dig

Every stock has a story, and in the case of 7dig, this narrative seems poised for growth. Delving into forecasts and growth opportunities can give a sense of where the value in this stock may be hiding.

The Future Unveiled

Forecasting the trajectory of 7dig’s share price is like peering into a crystal ball. However, market analysts and algorithm-based tools can provide some degree of certainty. Looking at product pipelines, upcoming contracts, and analyst recommendations can paint a picture of potential future stock valuations.

Uncovering Opportunities

Understanding the strategic moves and positioning of companies like 7dig within their industry is vital. From the integration of new technologies to forging alliances, recognizing where there’s room for growth within the company can guide investors in identifying potential investment entry points.

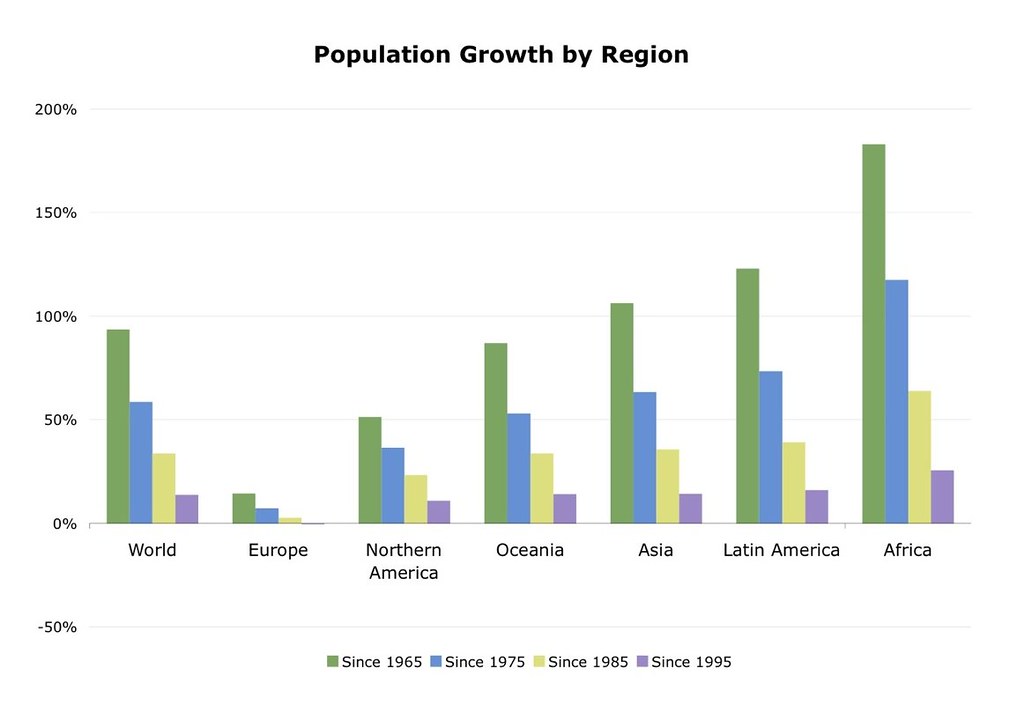

In the Arena: 7dig’s Peers

Putting 7dig’s performance into perspective requires a comparative lens. This section will compare and contrast how 7dig’s share price movements stack up against its competitors, shedding light on its relative strength and weaknesses in the market.

The Benchmark Battle

Selecting direct competitors or a market index can serve as a benchmark for understanding how 7dig’s stock price performance aligns with industry standards. Commonly compared metrics include price-to-earnings ratios, price-to-book ratios, and growth projections.

Sounding the Alarm: Expert Predictions and Opinions

The verdict of financial analysts can often tip the scales for an investor. Here, we would gather insights from the experts on what the future roadmap of 7dig’s share price may look like.

Weighing in on 7dig

Experts can provide a broader perspective on factors influencing share prices, offering up a mix of technical and fundamental analysis to paint a more detailed picture of where 7dig sits in the grand scheme of things and where it may be headed.

Crafting Your Investment Strategy for 7dig

Armed with insights and industry knowledge, it’s time to plot a course. Whether you’re a seasoned trader or just testing the waters, formulating an investment strategy tailored to 7dig can be the difference between profit and loss.

Short-Term vs. Long-Term Gains

Identifying one’s investment goals is the first step, followed by aligning these objectives with the appropriate investment strategy. Identifying the entry and exit points, setting stop losses, or holding through business cycles could be critical considerations for investors.

Diversification and Education

It’s a stock market adage for a reason—don’t put all your eggs in one basket. Spreading investments across different sectors and types of assets can mitigate risks, while continuous education ensures investors are making informed and strategic decisions.

Sail On, Intrepid Investor

In the grand mosaic of the stock market, 7dig has carved out a niche that calls to the bold and the strategic. The potential for gains is palpable, but so are the risks. It’s this balance that often defines a successful investor. Embarking on a deeper exploration of 7dig’s share price could be the first step towards an exciting, and hopefully rewarding, investment journey.